what nanny taxes do i pay

According to IRS Publication 926 youre exempt from paying the nanny tax and the Federal Unemployment Tax Act FUTA in 2019 if your nanny is a. The current rate is 6 but you can receive a credit of up to 54 if you also pay state.

How To Pay Nanny Taxes Yourself

This form shows your wages and taxes withheld and is attached to your income tax return.

. You need both federal and state tax identification numbers to report and pay your nanny taxes. For the 2022 tax year nanny taxes come into play when a family pays any household employee 2400 or more in a calendar year or 1000 or more in a calendar quarter for unemployment. You get your federal employer identification number FEIN from the IRS.

Like other employers parents must pay certain taxes. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. The Nanny Tax Company has moved.

The 2022 nanny tax threshold is 2400 which means if a. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and. Only the employer pays FUTA on up to 7000 of an employees annual wages.

How much tax do I pay as a nanny. The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. Multiply the number of hours by the hourly wage.

There are three reasons you should pay nanny taxes. If you have a nanny or any household employee who makes more than 2300 in a calendar year you have to pay a combination of state and federal taxes. Its the right thing to do not only are you protected if audited but your employee benefits from being paid legally.

The net is your nannys take. These taxes include social security and Medicare taxes FICA and Federal Unemployment. Employer payroll taxes normally range between 9-11 of wages depending on your state.

What is commonly referred to as the Nanny Tax is pretty simple actually. If your nanny is a W-2 employee. You need BOTH of these conditions to be true.

Calculate social security and Medicare taxes. Nanny Household Tax and Payroll Service. Our new address is 110R South Prospect Ave Park Ridge IL.

What Are The Expected Tax Costs. If your nanny is a W-2 employee you must withhold taxes. This is the gross wage.

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. She will have a record. If your nanny is a household employee you will typically have to pay nanny taxes.

What are these taxes. You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. As a general guide you can expect to pay in the low-20s per hour for less experienced care and in.

Its the employers share of social security and medicare tax on wages and the employees social security and. When you catch-up with a previous year it will be. You and your employee each pay 765 percent of gross.

Register as an employer. Nannies will typically cost 25-30 per hour. Subtract Social Security and Medicare taxes income taxes and any other state or local taxes that may apply generally about 10 percent of gross pay.

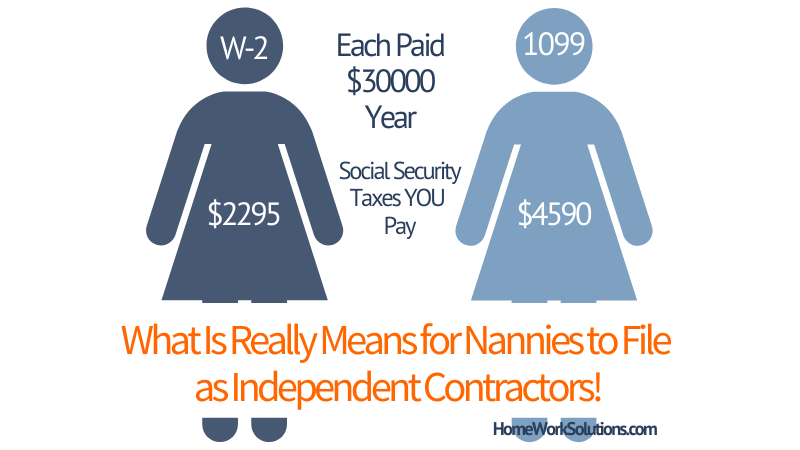

The difference lies in the way you pay your nanny and how he or she claims the income on his or her income taxes.

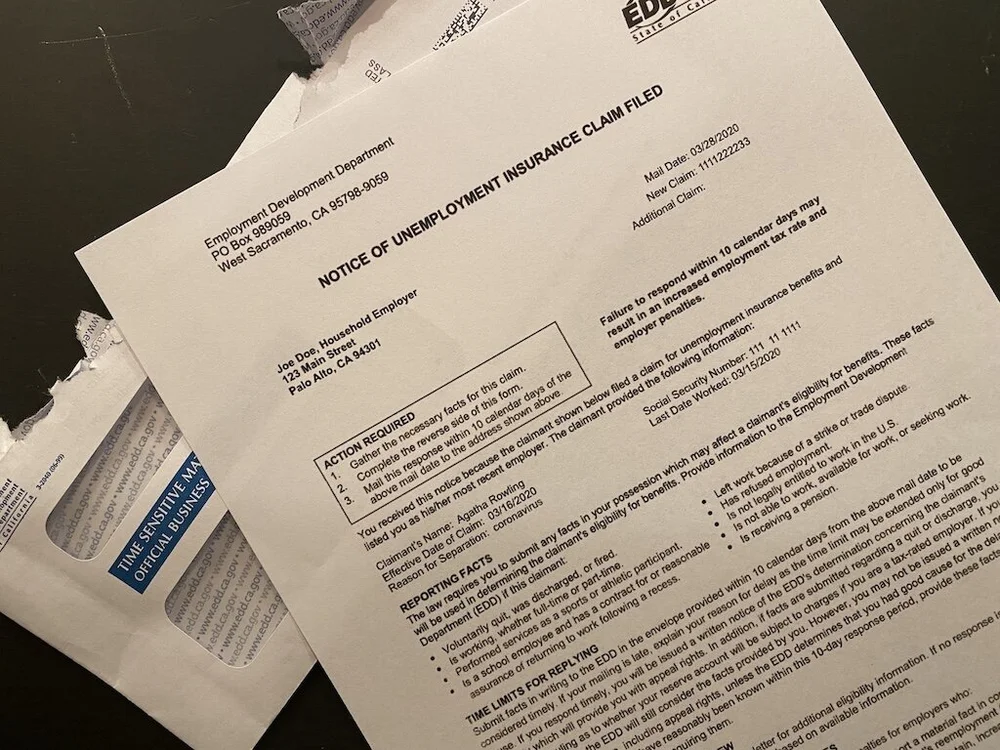

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

How Do Nanny Taxes Work Date Night Boutique

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Catch Up On The Nanny Tax Nest Payroll

How Does A Nanny File Taxes As An Independent Contractor

Paying Your Nanny Legally In Texas The First Milestones

More Nanny Taxes What To Do If They Accidentally Give You A 1099 Youtube

You Re Not The Only One Who S Not Paying Your Nanny Tax Wsj

Nanny Tax Rules How You Know If You Owe Payroll Taxes For Someone Who Works In Or Around Your Home

Nanny Taxes Explained Tl Dr Accounting

A Guide To Nanny Tax Compliance For Accountants And Their Clients

What Is The Nanny Tax And How Do I Pay It For Household Employees

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Guide To Household Employment Payroll Taxes Hws

The Nanny Tax How Does It Work Inside Indiana Business